Eligibility for these tax deductions rests on meeting certain Internal Revenue Service (IRS) criteria.

If your motorhome has sleeping, cooking, and toilet facilities, it can qualify as a second home under the IRS regulations. This means I can deduct the interest on my RV loan just as I would with a traditional brick-and-mortar second home.

Please be aware that the content of this article is intended solely for informational purposes and does not constitute professional tax advice. I am not a certified tax professional, and the information provided is based on a general understanding and interpretation of tax regulations, which are complex and subject to change. It is essential for readers to consult with a qualified tax advisor or accountant for personalized advice and to confirm the current tax laws and regulations related to motorhome deductions. The author and the publisher of this article do not accept any responsibility or liability for any errors or omissions, or for any actions taken based on the information provided herein.

Eligibility Criteria for RV Tax Deductions

Defining a Qualified Motorhome

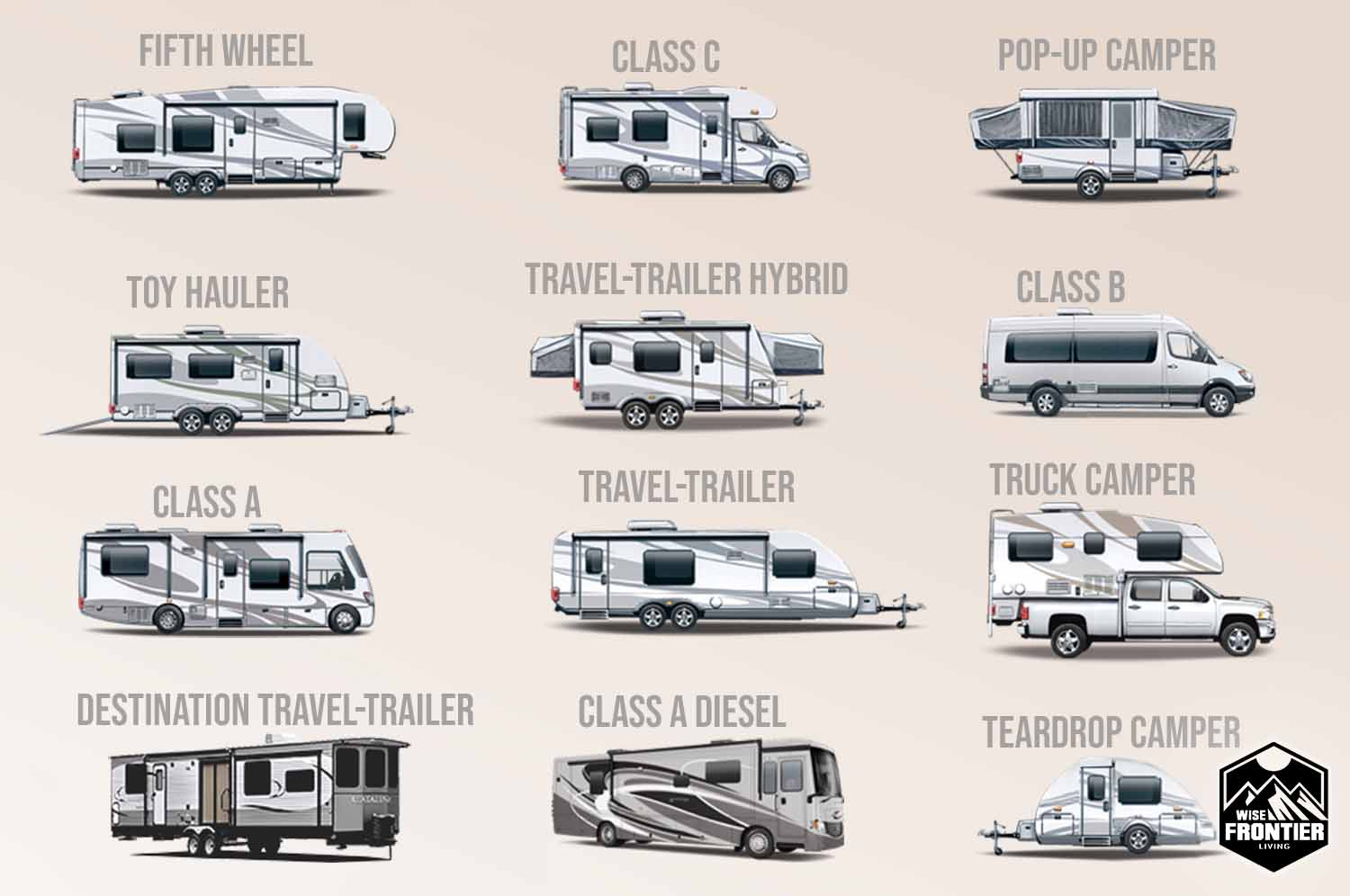

A motorhome is considered a qualified vehicle for tax deductions when it includes sleeping facilities, cooking facilities, and toilet facilities.

If my RV features all of these, it may be classified as a second home or even a primary residence. This qualification allows for certain tax-deductible expenses.

- Sleeping Facilities: A dedicated area for resting and sleeping.

- Cooking Facilities: Equipment that allows the preparation of meals.

- Toilet Facilities: A restroom within the RV.

For tax deductions to apply, the motorhome must have these facilities and be used during the tax year.

The Role of RV Loans in Tax Deductions

For the interest on an RV loan to be tax deductible, the loan must be secured by the RV itself, making the vehicle collateral.

This mirrors the requirements for the traditional home mortgage interest deduction. It is essential that this RV loan is similar to a mortgage, which is a loan secured by real property.

- Loan Interest: Must be on a loan where the RV is collateral to be tax deductible.

- Loan Type: Reflects traditional home mortgage structures.

If these conditions are met, the interest payments on your RV loan can be considered for deduction under the same tax rules as a home mortgage.

This potential deduction can significantly impact the costs of owning an RV, making it more financially feasible.

To capitalize on these deductions, your RV must meet IRS definitions, and the loan must adhere to requisite terms. Bringing your RV into compliance with these rules can afford you welcomed tax benefits.

Tax Deductions Applicable to Motorhomes

Motorhomes can be a boon come tax season, especially if you qualify for certain deductions. Here’s how you might reduce your tax bill with a motorhome.

Mortgage Interest Deductions

If your motorhome qualifies as a second home, you can might claim the home mortgage interest deduction. This is applicable if the RV contains sleeping, cooking, and toilet facilities.

Your can deduct interest on up to $1 million of the mortgage debt. This is beneficial if you’ve financed my motorhome or RV. However, you must itemize your deductions to benefit from this.

Property Tax and Sales Tax Deductions

Property taxes are a key consideration. In many states, you might deduct either state income taxes or state sales taxes, and in some affected cases, even personal property taxes on the RV.

If your state treats my motorhome as personal property, you can deduct the amount paid each year as personal property taxes.

Registering an RV in another state can influence my tax situation, and I should consider the best domicile options.

Business Use of RV and Deductions

When using the RV for business purposes, you must document all business expenses thoroughly. If you operate an RV rental business or use the motorhome for business travel, expenses related to the use of the RV can be deducted.

These expenses are reported on a Schedule C. It pays to keep meticulous records of these business-related costs throughout the year.

To benefit from these deductions, you usually need to exceed the standard deduction amount, making itemized deductions worthwhile.

Understanding Limitations and Exceptions

When considering tax deductions for your motorhome as a primary or secondary home, it’s essential to understand that federal tax laws have specific limitations and exceptions that apply.

Loan Deduction Limits and Phaseouts

For RV owners, the interest on your RV loan may be deductible, similar to a mortgage interest deduction.

However, under current tax rules, the loan balance eligible for interest deduction is capped at $750,000 for married couples filing jointly and $500,000 for single filers or those married but filing separately.

This limitation comes into effect if the RV loan was taken out post-December 15, 2017.

It’s critical to note that these phaseouts might further reduce your deductible amount based on your overall income levels, making it advisable to consult with a tax professional or use tools like TurboTax to accurately determine your deductible amount.

Personal Use vs. Rental Use

The dynamics change significantly when your RV is used for both personal use and rental purposes. To qualify for a tax deduction on your RV as a second home, you must use it for more than 14 days or more than 10% of the total days it’s rented out, whichever is greater.

If you rent out your RV, you’ll need to meticulously record your personal vs. rental use to ensure compliance with federal tax laws.

Remember that if the RV is rented out for the majority of the time, deductions are no longer applied in the same way, as the RV could be considered a business asset, and different business deduction rules would apply.

It’s also crucial to understand how personal use impacts your tax situation and potential deductions, and staying in regular consultation with your tax professional can provide clarity regarding your circumstances.

The Process of Claiming RV Tax Deductions

Before filing your tax returns, it’s critical to understand the eligibility and documentation needed for RV tax deductions. This can help optimize your tax benefits.

Documenting for Deductions

For RV tax deductions, meticulous documentation is crucial. I keep a file for receipts and records that reflect the sales tax paid if I’m claiming the RV sales tax deduction.

This deduction is applicable to me only in the year of purchase. Additionally, if my RV qualifies as a second home, I ensure the loan is secured by the RV, making it eligible for mortgage interest deductions.

For this, I preserve Form 1098 or similar statements from my lender, which reports interest I’ve paid over the year.

Filing Taxes with RV Deductions

When I prepare my tax returns, I determine if itemizing deductions on Schedule A is more beneficial than taking the standard deduction.

Itemized deductions must exceed the standard deduction threshold to provide any tax benefit. This includes mortgage interest and possibly other deductible expenses related to my RV. To itemize, I use Form 1040 and attach Schedule A, listing all deductible expenses.

Consulting with an accountant can ensure you accurately claim these deductions and comply with IRS requirements.

If faced with complex scenarios, such as buying an RV from a private seller with a loan, the expertise of a professional is invaluable to navigate the tax implications.

Long-Term Considerations for RV Owners

Owning a motorhome is not just about adventurous travels; it’s crucial for you also to think about how it affects your personal finance over time.

Tax considerations and the depreciating nature of this asset play a substantial part in my long-term planning.

Planning for Future Tax Years

You must strategize for future tax years to ensure you get the most out of possible deductions.

This might mean deciding whether to list your RV as a business expense if it serves as a workspace or a mobile office.

With evolving tax laws, engaging a tax professional annually can help you make informed decisions and potentially find new opportunities for deductions.

RV Depreciation and Tax Implications

Just like classic vans or conversion vans, motorhomes are subject to depreciation, which can impact your financial planning.

Understanding the patterns of RV depreciation is crucial. It becomes significant when you sell or trade in my RV because it will affect the sale price versus my purchase price, which can have tax implications.

Additionally, if your RV is covered under a strong warranty, this can influence its long-term value and the timing of key maintenance decisions. It’s sensible for you to consider which RV brands offer comprehensive warranties when making an initial purchase or evaluating long-term costs.

Leave a Reply