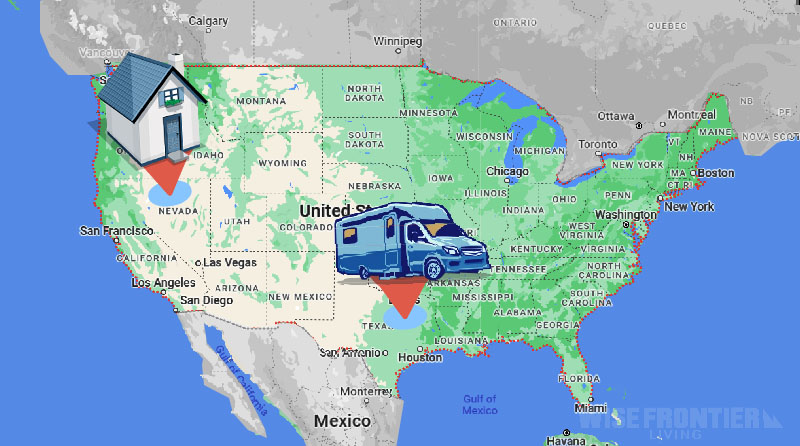

With the ability to take your home on the road, you’re not tied down to one location. This flexibility also extends to the realm of registration and domicile.

Many RV owners consider registering their vehicle in a state other than their primary residence, often for financial benefits. But is it as simple as picking a state and getting a new license plate? Let’s dive into the intricacies of RV registration, the concept of domicile, the legal implications, and the potential benefits.

Domicile vs. Residency: What’s the Difference?

At first glance, ‘domicile’ and ‘residency’ might seem interchangeable. However, there’s a crucial distinction. Residency is temporary – it’s where you’re currently living. On the other hand, domicile is your permanent home, the place you always intend to return to, even after periods of being away. While you can have multiple residences – say, a summer home, a winter chalet, and an RV – you can only claim one domicile.

The distinction becomes critical when discussing legal matters, taxes, and RV registration. Most states require establishing domicile to register a vehicle, which might involve more than merely filling out a form.

Establishing Domicile: What’s Required?

Requirements vary from state to state. Commonly, you might be asked to:

- Obtain a local driver’s license.

- Register to vote in the state.

- Spend a specific number of days in the state each year.

- Show proof of a physical address, which can be challenging for full-time RVers but not impossible with services designed to help, like mail-forwarding services.

Why Consider Registering Your RV in Another State?

Several reasons make registering an RV in another state appealing:

- Lower Registration Fees: Some states have significantly cheaper vehicle registration fees, which can result in substantial savings, especially for high-end RVs.

- Favorable Insurance Rates: Insurance premiums can vary wildly from state to state. By registering in a state with lower rates, you could potentially save hundreds or even thousands of dollars annually.

- Tax Benefits: As of 2022, states like Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t have a state income tax. For those with significant income, this can mean substantial savings. [Source]

Potential Pitfalls and Legal Implications

As tempting as the benefits sound, there are potential pitfalls to be aware of:

- Tax Evasion vs. Tax Avoidance: Everyone loves to save money, but it’s essential to do it legally. Tax avoidance is using legal methods to reduce the amount of tax you owe. In contrast, tax evasion – which involves breaking the law to avoid taxes – can lead to hefty fines or even imprisonment.

- Insurance Complications: Informing an insurance company that your RV is primarily kept in one state while it’s often in another can be a form of fraud. It’s crucial to be honest about where your RV is ‘garaged’ to ensure you’re covered in case of an accident or other incidents.

- Sales and Use Taxes: Evading sales tax by buying an RV in a no-sales-tax state can backfire if your domicile state has a use tax, essentially a tax on items purchased outside the state but used within it.

- Legal Jurisdiction: In the case of legal disputes, your state of domicile might have jurisdiction, which can be a benefit or drawback, depending on the specific circumstances.

Popular “Tax-Friendly” States for RV Registration and Their Requirements

Given the complexities, why do so many people consider this? Some states have become popular choices due to their favorable conditions for RVers:

- South Dakota: Often touted as the most ‘RVer-friendly’ state, South Dakota has no state income tax, low insurance rates, and reasonable vehicle registration fees. To establish residency, one only needs to stay a night in a South Dakota campground and show the receipt, get a South Dakota address (mail-forwarding services can help), and then obtain a South Dakota driver’s license.

- Texas: With no state income tax and a straightforward residency process for full-timers, Texas is another favorite. The Escapees RV Club, based in Texas, provides mail-forwarding and helps RVers establish domicile in the state.

- Florida: The Sunshine State has no income tax, and establishing residency is relatively easy. For full-time RVers, a mail-forwarding address often suffices. Florida also offers another advantage: no vehicle inspection requirements for RVs.

In 2022, 444,484 individuals settled in the state of Florida and 450,000 in the state of Texas.

Generalized list of RV registration fee structures by state:

- Alabama: Based on the length and type of the RV.

- Alaska: Flat fee, depending on the type of RV.

- Arizona: Value and weight-based fee.

- Arkansas: Weight-based fee.

- California: Value-based fee, with additional weight fees for larger RVs.

- Colorado: Weight and age-based fee.

- Connecticut: Flat fee based on the type of RV.

- Delaware: Flat fee.

- Florida: Weight-based fee.

- Georgia: Value and weight-based fee.

- Hawaii: Weight-based fee.

- Idaho: Age and value-based fee.

- Illinois: Flat fee based on type.

- Indiana: Weight-based fee.

- Iowa: Weight and value-based fee.

- Kansas: Weight and value-based fee.

- Kentucky: Flat fee.

- Louisiana: Weight-based fee.

- Maine: Flat fee based on type.

- Maryland: Flat fee.

- Massachusetts: Flat fee based on type.

- Michigan: Weight-based fee.

- Minnesota: Value-based fee.

- Mississippi: Flat fee.

- Missouri: Horsepower and length-based fee for boats; likely weight for RVs.

- Montana: Flat fee based on type and age.

- Nebraska: Value and weight-based fee.

- Nevada: Weight and value-based fee.

- New Hampshire: Weight-based fee.

- New Jersey: Flat fee based on type.

- New Mexico: Weight-based fee.

- New York: Weight-based fee.

- North Carolina: Flat fee.

- North Dakota: Weight-based fee.

- Ohio: Flat fee based on type.

- Oklahoma: Value-based fee.

- Oregon: Flat fee.

- Pennsylvania: Flat fee based on type.

- Rhode Island: Weight-based fee.

- South Carolina: Weight and value-based fee.

- South Dakota: Weight-based fee.

- Tennessee: Flat fee.

- Texas: Weight-based fee.

- Utah: Weight and value-based fee.

- Vermont: Flat fee based on type.

- Virginia: Weight-based fee.

- Washington: Value-based fee.

- West Virginia: Weight-based fee.

- Wisconsin: Flat fee.

- Wyoming: Weight-based fee.

These are generalizations based on the fee structures used by states as of 2021. Actual costs and the exact way fees are calculated can vary. Always refer to the official state agency for precise and up-to-date information.

Conclusion

Registering your RV in a state other than your primary residence can offer tangible financial benefits. However, it’s not a decision to be taken lightly. Establishing domicile requires adhering to state-specific requirements and understanding the implications for taxes, insurance, and legal matters.

If you’re a full-time RVer or even a part-timer considering this route, it’s essential to conduct thorough research, perhaps consulting with legal and tax professionals. After all, the open road is much more enjoyable when you know you’re navigating it with all the necessary legal and financial considerations in your rear-view mirror.